CREDIT UTILIZATION PERCENTAGES

Exactly How Utilization Affects Our Scores And Why...

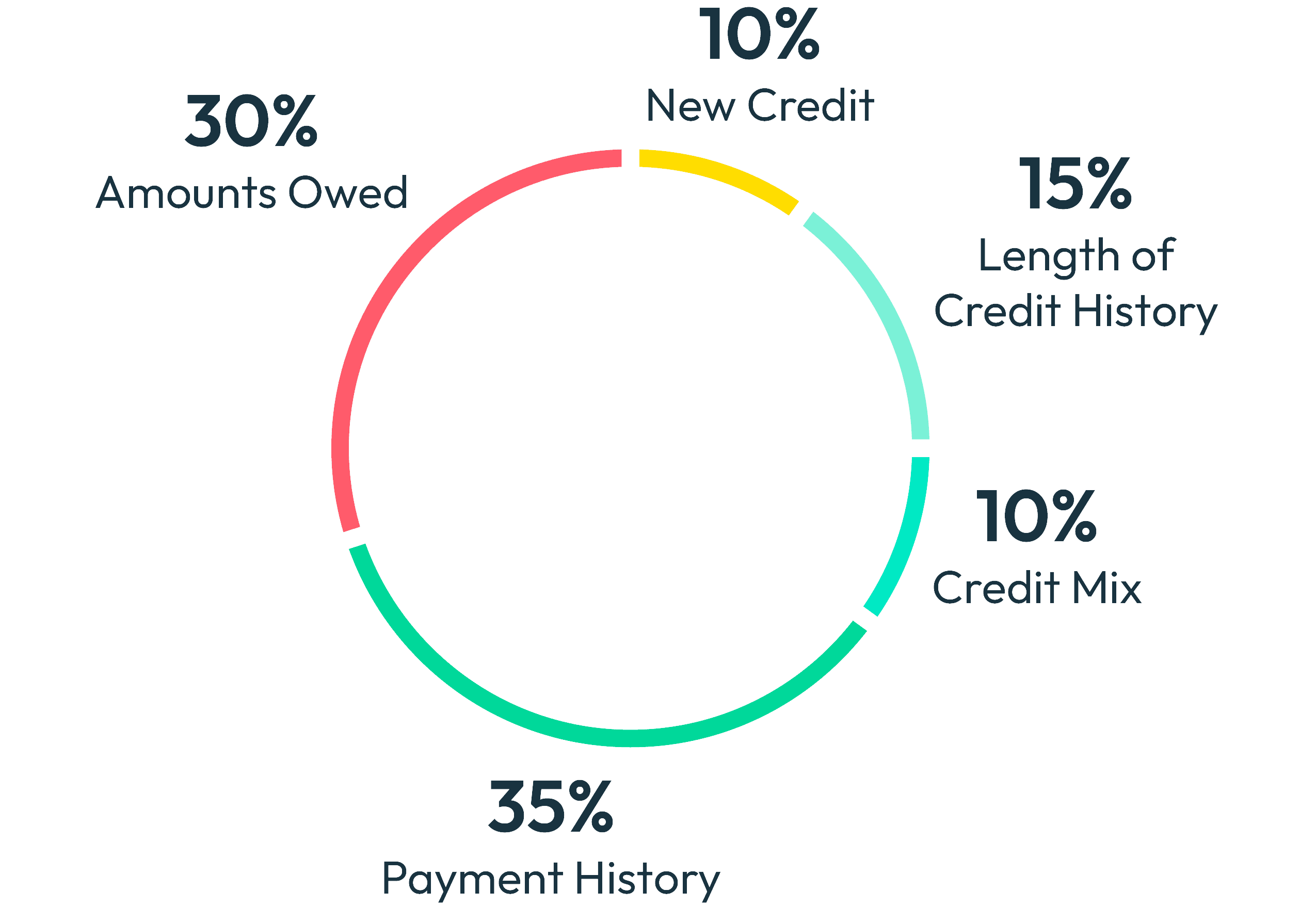

Credit utilization (amounts owed - 30% factor for your scores) is a key factor in determining your credit score, as it represents the percentage of your total available credit that you are currently using. It is calculated by dividing your total credit card balances by your total credit card limits and is expressed as a percentage.

A lower credit utilization ratio is generally better for your credit score.

According to various sources, a good credit utilization ratio should be kept under 30% (but not if you're in raise them up mode).

People with the best credit scores often have a credit utilization number in the single digits (0-9%). Keeping your balances and utilization ratio as low as possible is recommended for the best chance at improving your scores immediately. All percentage points (or more available credit), gives you a few more extra points added to your scores!

You can test this right now by simply paying down balances and watch your scores go up, as soon as those changes are reported. Pay the balances down a few days (about 5 days), before that cards numbers are reported to the credit bureaus (usually on or around the due date - different for every card), and don't use that card until it's updated on your credit report showing the lower or zero balance. Then check daily and watch your scores go up!

There are two types of credit utilization ratios: per-card and overall. Per-card utilization measures how much of each card’s credit limit you’re using, while overall utilization takes all your cards and their limits into account.

Both per-card and overall utilization rates are important and can impact your credit scores.

Example: A total credit limit amount of $10,000 (could be just one card or multiple cards), and $1,000 is reported to the credit bureaus as being used (or total balance owed), which would equal a 10% credit utilization (or 10% of the available credit used). As the percentage of credit used (% reported to the credit bureaus), fluctuates from month to month, so do the scores fluctuate.

As you can imagine, going from 100% credit card utilization, to 0%, would have a huge impact on your scores, from lower to much higher. So just paying down all of your cards will have a very positive effect on your scores, immediately!

So, to improve your credit utilization ratio, you can:

Make payments throughout the month to reduce your credit card balance.

Set alerts on your credit cards to notify you once you’re close to hitting 30% (or less) to stay on top of spending.

Ask for a higher credit limit, but only if you commit to not overspending and not using the newly available credit (to boost your scores).

Closing a credit card account that you no longer use can hurt your credit score by reducing your total available credit (never do this while working to boost your scores - maybe at a later date when your goals are accomplished and the affect will be less). This can increase your credit utilization ratio and potentially decrease your scores.

In summary, maintaining a low credit utilization ratio is crucial for good credit scores, and keeping it in the 1-6% range is considered ideal, for maximum extra points, especially when in credit boosting mode...

Although, it's not crucial to start, if you're working to remove several negatives that are doing the most damage to your scores. Getting those removed first, will have the most positive impact initially, then boosting your scores to the max, can then be accomplished by paying down your cards as well. Using a debt consolidation loan could be a fast way to do that, if not possible with your current income.

Plus, using cards to pay as many living expenses as possible, then put as much income on your cards as possible, can help reduce utilization, interest amount and lower payments, while still using them. Pay them down/off a few days before they're reported to keep utilization at a minimum. Maybe request credit limit increases when your scores are high (say 720+), to increase available credit, thus lowering your utilization further, giving you another boost to your scores. The harder you work this system, the easier it becomes to rise above it all!

NEVER miss a payment (payment history 35% factor - The highest % of all factors used to calculate your scores) even if you pay the minimum amount owed, pay it. If you have missed a payment, start now never missing another, while in the process of building your credit up. It will all come back stronger than ever if you get started now, and keep building momentum, stay on track, make good choices and remove the negatives (including all missed/late payments)...